Africa Must Urgently Develop Vaccine Manufacturing Capacity

- Reliance on global supply chains has left Africa unable to secure adequate vaccines and critical medical supplies to combat the coronavirus pandemic.

- As a result, vaccination rates are dismally low even amid lethal variant-driven waves. Of the 3bn Covid vaccine doses administered globally this year, less than 2% are in Africa. And with close to 80% of Africa’s current vaccine supply already administered, only c.1% of the region’s population has been fully vaccinated.

- Based on current trends, Africa is significantly behind global targets to combat the pandemic. Africa has received just 6.5% of the total vaccine supply that would be required to vaccinate 60% of the adult population – a conservative estimate of the herd immunity threshold. With most of the available vaccines already snapped up by wealthier regions, Africa faces significant supply challenges in getting from the 61m doses already received to the additional c.420m and c.500m doses needed in 2021 and 2022, respectively.

- International donation and procurement initiatives such as COVAX and the African Union’s AVATT programs are insufficient to assure the supplies needed for a mass vaccination campaign across Africa. The solution lies in Africa developing its own vaccine manufacturing capacity as the central plank of a continental strategy for exiting the Covid-19 pandemic. This should be coupled with boosting health infrastructure over the longer term.

- Scaling up Africa’s vaccine manufacturing will still depend on international cooperation. It will require the cooperation of global manufacturers through vaccine technology transfers and opening up of supply chains for vaccine raw materials. This is a model that is being promoted by the World Health Organization and the World Trade Organization.

- Developing local manufacturing capacity in medical supplies, including vaccines, and investing in health infrastructure, are critical factors for Africa’s future health and economic security.

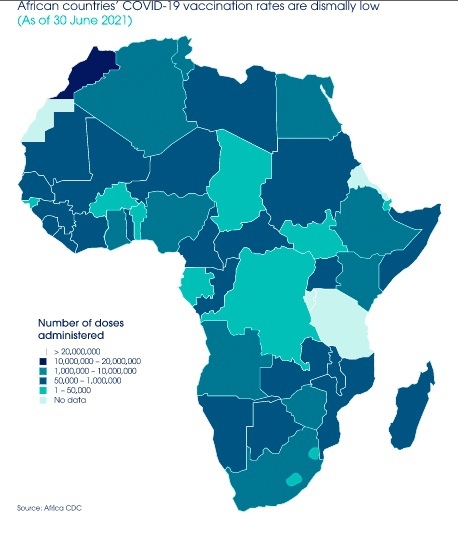

AFRICAN COUNTRIES’ COVID-19 VACCINATION RATES ARE DISMALLY LOW (AS OF JUNE 30, 2021)

Source: Africa CDC

Africa’s vulnerability to global supply chains is on brutal display. After what appeared to be relatively mild first and second waves of the coronavirus pandemic, Africa now faces a variant-driven, highly contagious, and more deadly third wave that is yet to crest. Without mass vaccination, further dangerous waves will likely recur, delaying Africa’s exit from the pandemic while the rest of the world moves on.

Most concerning is that, despite the lowest inoculation rate of any region globally, vaccine doses are running perilously low. And Africa finds itself at the back of the line to replenish stock.

The lesson that has become abundantly clear is that medical supplies need to be viewed as critical national security goods whose production must never be entirely outsourced. Covid has upended Ricardian economic theory that it is better for consumers to import goods for which a country or region has no comparative advantage in producing locally.

As everywhere else in the world, exiting the pandemic and easing the economic and human toll requires the vaccination of a critical mass of the population to achieve herd immunity. This demands an urgent marshaling of efforts to boost vaccine production while also channeling investment into Africa’s health infrastructure and capacity to produce medical supplies.

Unable to secure adequate quantities of vaccines and critical medical supplies, Africa has so far received 61.4mn doses, just 6.5% of the estimated 1bn required to inoculate 60% of the region’s adults, the so-called minimum herd immunity threshold needed to bring an end to the pandemic[1].

Inoculation rates remain dismally low. Of the nearly 3bn Covid vaccine doses administered globally, less than 2% were in Africa. And with close to 80% of the region’s current vaccine supply already administered, only c.1% of the population has been fully vaccinated. While the continent has placed enough orders to meet Africa CDC’s target of 60% vaccination by the end of 2022, deliveries are unlikely to materialize before late 2022/ early 2023 due to order backlogs made worse by India’s decision in May to prioritize vaccinations at home amidst soaring infection rates.

[1] The WHO has suggested the global herd immunity threshold is at least 70% or perhaps higher given new variants.

Securing enough Covid-19 vaccines for Africa’s needs appears increasingly impossible without a continental vaccine production strategy

Sources: IMF, Haver Analytics, AFC Research 1/ Assumes 2 doses per adult; extrapolated from IMF analysis

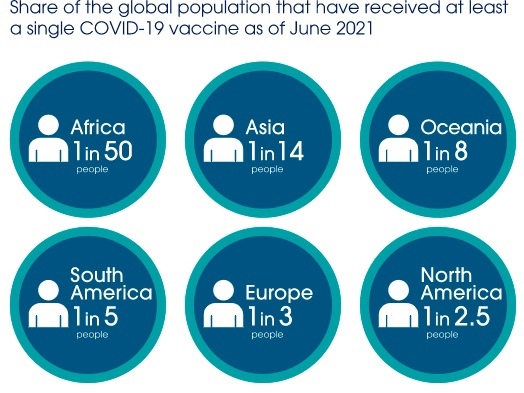

Africa’s vaccination rates against Covid-19 are the lowest of any region of the world

Share of the population that have received at least a single COVID-19 vaccine as of June 2021

Based on current trends, Africa will be held back from reaching global herd immunity targets, with significant and long-lasting economic and development implications. The region is already significantly lagging behind the IMF’s proposal to end the pandemic by vaccinating at least 40% of the population in all countries by end-2021, and at least 60% in the first half of 2022. In fact, not a single African country is on track to meet these targets. Morocco, which has by far the highest inoculation rate in Africa, has vaccinated 22% of the population and exhausted 94% of current vaccine stocks.

Prolonged development setbacks come on top of output contraction and human development losses experienced in 2020. Amidst the region’s first recession in 25 years, economic output is not projected to return to pre-pandemic levels before 2023. In short, the region faces a “lost decade” or more if it fails to raise vaccination rates.

International proposals to date are insufficient for the urgency and scale of the threat to Africa from new waves. Having purchased a third of all global production capacity for 2021, G7 governments recently announced plans to divert excess supply of some c.500m doses to poorer countries through the COVAX facility. Crucially, however, the promised excess supplies are not expected until “sometime in 2022,” too late to get ahead of the much more contagious and lethal third wave of the pandemic currently unfolding across Africa.

For all its benefits, the COVAX program was only ever intended to vaccinate 20% of the population and cannot deliver the doses needed to fully vaccinate Africa’s population. And while the African Union expected a further 30% vaccination coverage through the African Vaccine Acquisition Task Team (AVATT)[1], the program faces delivery delays owing to global manufacturers’ order backlogs.

Africa’s current vaccine manufacturing capacity is extremely weak, and thus any efforts are starting from a low base. Currently there exist only ten identified African vaccine manufacturers, and they are consolidated in seven countries: Egypt, Ethiopia, Ghana, Nigeria, Senegal, South Africa and Tunisia. Four manufacturers — the Pasteur Institutes in Dakar, Tunis and Algiers, and Biovac in Cape Town — have the capacity to manufacture the substances that vaccines are made of. Ethiopia Public Health Institute in Addis Ababa and Biovaccines in Lagos have announced plans to reach that point. Two manufacturers (i.e., Vacsera in Egypt and Aspen in South Africa) plan to be only ‘fill and finish’ processes, or packaging and labeling. The sector’s inability to compete with cheaper imported vaccines has been cited as a key limiting factor in local production.

Urgent scaling up of local vaccine manufacturing for Covid-19 vaccine requirements depends on international cooperation. The World Health Organization and World Trade Organization have promoted establishment of vaccine manufacturing hubs in Africa. This is supported by technology transfers from richer countries facilitated by the WHO. The first such hub is currently being set up in South Africa with a consortium of South African companies, and in time is expected to provide training to other manufacturers across the continent.

However, the speed at which these new hubs will be able to swing into full-scale production depends on whether pharmaceutical companies with proven mRNA vaccines will commit to supporting the initiative.

As things stand today, global vaccine production supply chains are concentrated in 13 countries. Producers in this “Vaccine Club” are both the main source and destination of exports of Covid-19 inoculation ingredients. It is therefore no surprise that the same group of countries also accounts for the highest vaccination rates globally.

Together, the Vaccine Club nations have fully vaccinated 60% of their 2.9 billion population as of June 2021. Given similar production capacity, Africa would have achieved a vaccination rate of 26%, compared to the current 1% of its population of 1.3 billion.

Opening these supply chains is critical to decentralizing global vaccine production and allowing Africa to develop its own local manufacturing capacity.

Once the pandemic subsides, there will continue to be a case for developing an African vaccine industry. Excluding Covid vaccines, Africa is the second largest purchaser of inoculations globally, accounting for 1.2 billion of the 5.5 billion doses produced for the global market in 2019.

Despite having the highest incidence of mortality from infectious diseases, Africa has lacked the capacity to manufacture essential vaccines. As a result, the region has faced rising costs from its import-dependent vaccine procurement setup. For example, even though international donors such as UNICEF and the Gavi Vaccine Alliance have helped to subsidize the cost of vaccine imports, co-financing requirements have meant that African countries’ annual public market vaccine sales are about $1.3 billion, or around a quarter of the $33 billion total global market. The overall dollar value of vaccine imports is probably higher still once factoring in private sector imports.

Beyond the immediate health and security imperative, there is a compelling commercial business case for developing vaccine manufacturing as the continent’s demand continues to grow. Africa’s current market of c.US$1.3billion is projected to increase to between US$2.3-5.4billion by 2030., This presents an untapped opportunity for investment in local manufacturing, together with the necessary enabling components of the industry, from research and development to cold chain storage.

While the domestic markets for most countries in Africa will be too small to enable economies of scale, the African Continental Free Trade Area (AfCFTA) agreement presents opportunities for intra-regional exports.

Developing local manufacturing capacity in vaccines and medical supplies is critical to Africa’s future health and economic security. As the world’s largest consumer of vaccines, Africa imported 99% of its vaccines pre-Covid, and relied almost entirely on global producers for products now proven as critical for public health and national security. As the only continent with an expanding population, Africa has a rapidly growing market for vaccines. Developing a continental vaccine production industry has clear economic and employment benefits.

The need to boost investment in Africa’s health infrastructure and develop self-sufficiency in vital medical and pharmaceutical supplies is clear in light of the Covid-19 pandemic. Looking further ahead, there is a need to improve preparedness for the next pandemic, which may not be as sparing on Africa.