Compendium of Africa’s Strategic Minerals 2026

The Compendium of Africa’s Strategic Minerals reframes the continent’s mineral endowment from a catalogue of resources into a system-level economic proposition. It shows that Africa’s mineral challenge is one of conversion—turning resources into infrastructure, industrial capacity, and regional value chains. By linking minerals to power, transport, industrial zones, demand fundamentals, and global supply-chain dynamics, the Compendium identifies where coordination can materially improve project economics, where beneficiation is commercially viable, and where Africa can anchor durable positions in both regional and global value chains. Its central message is clear: Africa’s mineral wealth becomes transformative only when embedded in infrastructure, aggregated demand, and integrated industrial systems.

Communiqués de presse

Our Key Findings

Africa Must Become More Intentional in Deepening its Geological Data Ecosystem

Africa hosts one of the world’s most diversified and strategically significant mineral endowments, with an estimated US$29.5 trillion in mine site value – approximately 20% of the global total (1). Of this, US$8.6 trillion remains undeveloped, equivalent to roughly 2.5 times the continent’s annual GDP.

- Africa’s estimated US$8.6 trillion in undeveloped mineral assets remains largely latent because the continent is structurally under-explored. Improving data availability and quality is therefore an imperative to address elevated risk perception and derisk investments across the value-chain.

- Building on this foundation, the Africa Finance Corporation invites governments, regional institutions, and private-sector partners to work alongside us to deepen Africa’s geological data ecosystem and improve data quality as a key tool to de-risk investments in the sector.

(1) Mine-site values are derived from the MinEx Global Deposits Database and refer to the estimated gross in-situ value of mineral resources at the mine gate, prior to processing, transport, royalties, taxes, or operating costs.

Beneficiation Works Where Demand Is Anchored Regionally

Across Africa, mineral beneficiation remains uneven, under-scaled, or disconnected from downstream demand. A more durable approach requires reframing African minerals as anchors for regional industrial demand clusters that reflect the continent’s long-term growth fundamentals.

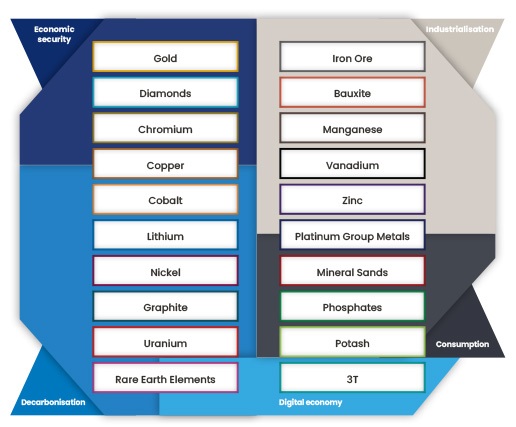

Africa represents the world’s largest upside in future demand for power, construction materials, food inputs, manufactured goods, and digital infrastructure—all of which are mineral-intensive. This demand directly translates into must-develop clusters:

- Infrastructure to expand railways, build ports or factories requires steel and ferro-alloys along with construction materials involving inputs made of aluminium, mineral sands or fluorspar

- Clean technologies and electrification (batteries, renewables, and energy-transition materials) to bridge Africa’s energy deficit need copper, aluminium, cobalt, rare earths, graphite, silver, or uranium

- Fertilisers to grow agriculture yields and achieve food self-sufficiency include a large share of phosphate and potash rocks

- Portable devices and electronics to equip the workforce of the future are anchored in tin, tantalum, tungsten, and battery minerals

- Automotive and machineries require lead and PGMs for traditional internal combustion engines or lithium, nickel, rare earths, manganese, cobalt or graphite for EV batteries.

Infrastructure is More Than Just an Enabler

Africa’s ambition to localise mineral supply chains only becomes economically meaningful when minerals are embedded in functional infrastructure ecosystems. Power cost and reliability, logistics availability, access to industrial land, and trade capacity ultimately set the ceiling on beneficiation and value capture.

For this reason, the Compendium introduces a continent-wide minerals and infrastructure map that identifies all operating mines and undeveloped deposits and links them to railways, ports, and major power generation hubs.

Trade and Geo-economic Realignment is Elevating the Strategic Relevance of African Minerals

Global mineral supply chains are under growing strain from trade tensions, export controls, industrial policy shifts, and concerted efforts to reduce concentration risk. Africa’s scale of mineral endowment and its broadly non-aligned positioning constitute genuine strategic advantages—but only if applied selectively and pragmatically. The objective is not to insert Africa indiscriminately into global value chains, but to position it where supply chains are most concentrated and where diversification would materially enhance resilience.

This imperative is most evident in minerals where supply chains are both highly concentrated and strategically sensitive.

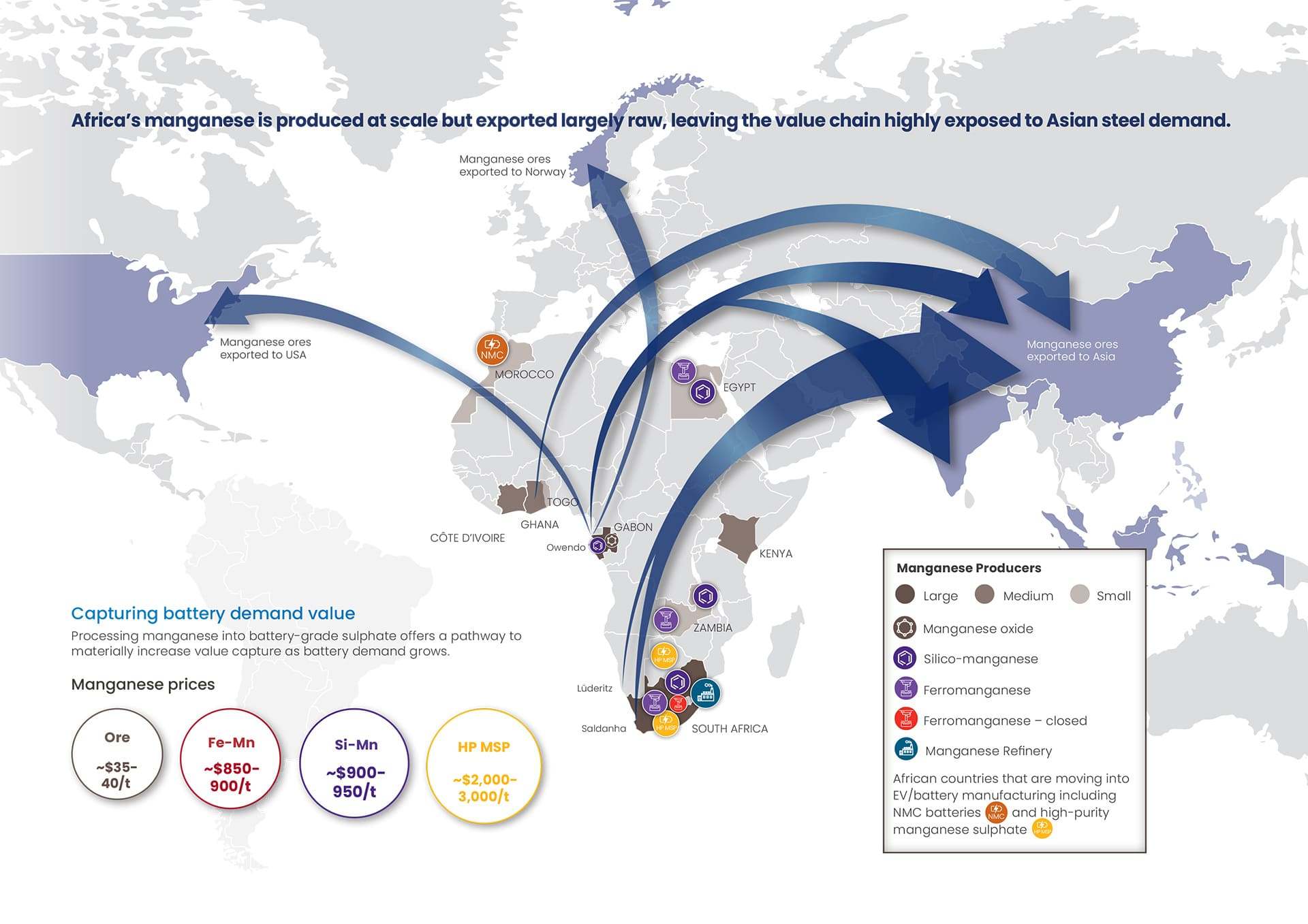

- China controls roughly 90% of global manganese refining, approximately 90% of rare earth separation and refining and dominates battery-grade graphite processing.

- Parallel concentration risks are evident in aerospace and defence supply chains—particularly for chromium, graphite, rare earths, and tungsten

- Uranium has also re-emerged as a strategic mineral as nuclear energy regains momentum, yet fuel conversion, enrichment, and associated services remain concentrated in a limited number of countries.

Against this backdrop, Africa is already moving from latent potential to active positioning.

- The continent’s first rare earth refinery is under construction in Angola.

- Mozambique has emerged as a supplier to the largest natural graphite and anode-material supply chain outside China.

- Battery-grade manganese sulphate projects are advancing in South Africa and Botswana.

- Uranium production has restarted at key mines in Namibia (2024) and Malawi (2025), signaling renewed momentum in a sector of growing strategic relevance.

Gold Enables Reserve Accumulation While Formalising African Economies

Gold offers a uniquely pragmatic opportunity for foreign currency-constrained African economies to strengthen external buffers while accelerating economic formalisation.

Africa hosts more than US$5 trillion in gold at mine-site value, including over US$1 trillion in untapped deposits. Yet gold accounts for only about $70 billion of Africa’s external reserves (IMF est.), or roughly 15% of total FX-reserve holdings.

Unlike most minerals, gold combines deep liquidity, transparent pricing, and rapid monetisation, enabling countries to convert domestic production directly into reserves rather than relying on volatile external inflows.