Our 8 brand statements

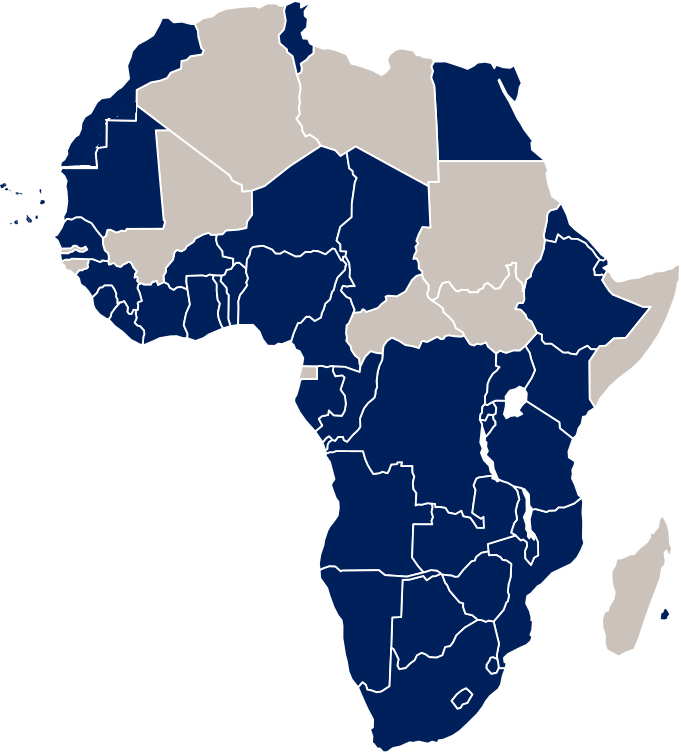

1. AFC is instrumental in helping Africa seize the moment to provide for the needs of a changing world.

Our new identity reinforces our role as the resilient and reliable bridge to a prosperous African future – aiming to advance Africa’s instrumental role as a global growth engine.

Through impact investing in infrastructure, AFC is committed to helping the continent position for greater success in a world of growing crisis and complexity.

From the minerals that power the global technology revolution, to the crops that feed the world, Africa can elevate its place as a global growth engine that is instrumental to the world.

We champion:

- Ushering in Africa’s ’Beneficiation Era’

- A fair and equitable energy transition for Africa

- Investment in climate-resilient infrastructure

- Investing in infrastructure to supercharge intra-Africa trade and help realise the AfCFTA.

2. We are the bridge to invest in the opportunities of a prosperous African future that we can build together.

From developing our gas reserves to rapid industrialization to intra-Africa trade and the AfCFTA, Africa needs capital to grow.

Our business is derisking projects, reliably managing funds and effectively deploying capital for maximum impact for the benefit of African economies and investors. As the steady navigator, we embody and amplify our investors aspirations to do well by doing good.

Our work impacts directly on the development of Africa whilst making risk adjusted returns for our shareholders and development partners. AFC encourages those seeking to invest in Africa to join with us to catalyse the change that Africa can achieve, whilst ensuring robust returns.

We support projects to completion, going further and faster to deliver the solutions that benefit the continent and those who invest in it.

3. From wind farms to green financing … we champion Africa’s sustainable development.

Infrastructure is Impact, and we help realise instrumental infrastructure that is resilient, sustainable and creates returns for our investors.

We already invest in some of the biggest wind farms in Africa, and our commitment to green financing is steadfast.

We play an important role in unlocking the potential of Africa’s key sectors by finding solutions to the challenges of sustainable infrastructure for generations to come.

4. We get things done.

We are motivated to achieve. We were conceived to find solutions that get projects past the finishing line and beyond.

Our energetic team of diverse professionals have introduced many firsts in our field such as project development and innovative construction finance.

For over 15 years AFC has proven that it understands how to proactively provide innovative solutions in an increasingly complex and challenging world.

5. We build special relationships.

We grow close and trusted partnerships throughout the investment process from day one.

Through our ecosystem approach, we work with our partners, including governments to make projects bankable and reach completion.

Through the many firsts we have introduced on the continent, including from financial advisory to project development, our partners understand that we offer a special relationship that that goes beyond mere financing because it is built on providing the right-fit solutions for investing on the continent. When you choose us as your partner, you feel the difference.

6. Our culture is execution.

Our solutions-culture allows us to credibly participate through the entire project life cycle, from concept design to construction to operations – a holistic approach where we seek to invest in every step of the value chain of a project.

To do this we harness our key strengths built up over many years:

- We are purpose-driven

- We are innovative

- We are collaborative

- We are entrepreneurial

- We are exponential.

7. We are innovative and evolving trendsetters.

The expertise of our diverse, talented and energetic team allows us to develop constant innovation and solve our partners’ challenges on everything from derisking projects to deploying unique investment solutions.

8. We are swift and agile.

We understand the mounting needs of our continent to develop urgently and at pace. We move with agility to swiftly structure and deploy capital in order to address the infrastructure gap, by acting as the resilient and reliable bridge to a prosperous African future.

Read more about us, our governance structures and our business model.