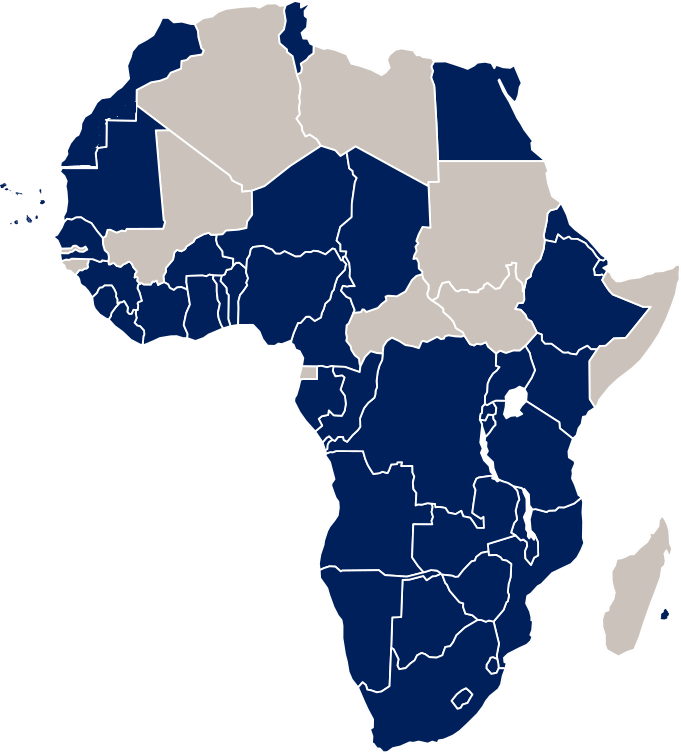

Investment footprint

Your at-a-glance guide to our current and recent investment activity

Footprint

An investment grade rated multilateral finance institution established to help address Africa’s infrastructure needs and challenges.

Overview:

- Founded in 2007 as a joint venture between public and private investors

- International organization established by treaty

- US$13bn in total disbursement; US$12.34bn in Total Assets; Total Equity of US$3.42bn including paid-in capital of US$1.5bn

- Investment footprint across thirty-six (36) African countries

- A-3 (Long-term Issuer)/ P-2 (Short-term Issuer) rating from Moody's

- Record of identifying, executing and delivering transformational infrastructure projects

- Specialist knowledge in key priority sectors: Natural Resources, Power, Transport & Logistics, Telecommunications and Heavy Industry

- Financial Advisory together with treasury and syndication services provide holistic support to a transaction cycle

- Synergies with a unique network of global and regional investments and advisory partners which include lenders, project sponsors, co-investors and consultants

- Strong partnerships with government and a strong infrastructure focused sovereign lending business

- Over 150 professional staff operating on a Pan African basis

- Strong project development expertise; Founder of Africa Infrastructure Development Association (AFIDA)

- Specialist knowledge in deploying products across the capital structure

$13bn disbursed to projects across 36 countries

- Nigeria (Host Country)

- Angola

- Benin

- Botswana

- Burundi

- Cameroon

- Cape Verde

- Chad

- Côte d'Ivoire

- Democratic Republic of Congo

- Djibouti

- Egypt

- Eritrea

- Ethiopia

- Gabon

- Ghana

- Guinea

- Kenya

- Liberia

- Malawi

- Mauritania

- Mauritius

- Morocco

- Mozambique

- Namibia

- Republic of Congo

- Rwanda

- Senegal

- Sierra Leone

- South Africa

- Tanzania

- Togo

- Tunisia

- Uganda

- Zambia

- Zimbabwe

Our history

2021

- AFC issues US$750 million 7-year Eurobond at a yield of 2.99%

- AFC announces Sameh Shenouda as Executive Director & Chief Investment Officer

- OPEC Fund for International Development provides AFC with US$50 million loan to support post-Covid 19 Africa

- AFC receives US$100 million loan from India Exim Bank to spur post-Covid recovery

- Guinea & Togo become shareholders in AFC

- AFC creates asset management division, AFC Capital and announces its Infrastructure Climate Resilient Fund. Ayaan Zeinab Adam announced as CEO of AFC Capital

- AFC secures US$250 million capital loan from US Government’s International Development Finance Corporation / Completion of maiden US$250 million tier-2 capital injection from the US International Development Finance Corporation (DFC)

- AFC reached 33 member countries up year to date in 2021 including Niger, Egypt, Burkina Faso, DRC & Morocco becomes member states

2020

- Net Income: US$156.6 million

- Total Assets: US$7.36bn

- Shareholders Equity grew to US$2.076bn on account of equity investments from CDC Gabon (the State pension fund of the Republic of Gabon) and the Arab Bank for Economic Development (BADEA)

- The Central Bank of Nigeria (AFC's biggest shareholder) completed a maiden equity warrant subscription

- AFC commits over N 500 million to Central Bank of Nigeria private sector coalition against Covid-19

- AFC issues US$700 million 5-year Reg S Euro bond

- Introduction of callable capital to the Corporation's capital structure

- Addition of Republic of Congo and Mali as member countries

2019 - 2020

- Madagascar, Mauritius, Mauritania, Namibia, Eritrea, Mali & Senegal become members and AfDB BADE and Gabon become shareholders

- Secured US$150m Samurai, US$140m Kimchi term loan facilities

- Issued CHF200m 4-year bond, US$500m Eurobond. US$ 650m Eurobond

- Net Income: US$183.3m

- Total Assets: US$6.1bn

2018

- Zimbabwe, Malawi and Togo join as members

- Africa Re became a sharehold

- Net Income: US$128.6

- Tatal Assets: LISS4 5hn

2017

- Benin, Kenya & Zambia joined as member countries

- Secured US$150m 15-year loan facility from KfW and issues a US$500m Eurobond

- Issued US$150m maiden Sukuk

- Net income: US$100.3m

- Total Assets: US$4.2bn

2016

- Djibouti joined as member country

- Launched Africa Infrastructure Development Association

- Net income: US$ 109.4m

- Total Assets: US$3.4bn

SummaryHighlights

SummaryHighlights

Coming soon!